Hi!! I hope you are having a great week! I have so many photos over the past few months that never made it to my blog. I debated just skipping over them and moving on. But I want them here–even when it feels like it’s way overdue. Anyway, this is going to be a very picture heavy post with pictures from the end of March to the end of May. Some are Instagram repeats and the others are just random photos from my camera and phone. I just really wanted to get these pictures up so I don’t feel guilty about moving on to other posts.

But before the photos, I just wanted to quickly answer a question from some of the comments on my last post about how we manage financially. A few people asked what we do about healthcare. We are a part of a Christian healthcare share plan. I honestly don’t know much about it but my husband researched it and we know a lot of families who use this type of plan. There are definitely pros and cons that go along with it. It’s about half the monthly cost that we were paying at his old job. We haven’t actually had to use it yet so I really can’t say how I like it. But for now, I can at least say that I like that it’s an affordable option for us.

This picture of my kids is one of my all time favorites! Liam (the oldest) came up with the pose and I love that Desmond and Clem are even attempting it. The picture below is what it usually looks like when we’re trying to get set up. Desmond is always the entertainer.

Kai was so proud when he got Primrose to fall asleep by cuddling her. It was the absolute sweetest sight. He spends quite a bit of time every day talking and playing with her.

Actually, they are all pretty obsessed with Primrose. There are usually a lot of arguments over who gets to hold her…especially when we’re taking pictures. I love this shot of the 4 youngest!

And this picture of Desmond–I was setting up for a different picture when I looked over and saw him talking to the baby doll. I quickly grabbed my camera and got a few shots before he noticed me. The pictures turned out a little blurry but I can’t get over how sweet he is!

This napping shot made me feel like a rockstar for a brief moment in time. I couldn’t believe I actually got a picture of both of them napping together. But shortly after I took this, Primrose flinched and Clementine’s eyes popped open haha. Thankfully I was able to pop her pacifier in, grab Primrose, and run out of the room. Clem ended up sleeping for a couple more hours and I ended up with the most adorable napping sisters picture!

This picture on the bed was absolute chaos to try to take but Primrose’s face makes all the chaos 100% worth it!

I have a lot of pictures of Desmond napping in random places. He doesn’t take scheduled naps everyday anymore. But a lot of days he ends up falling asleep for a couple of hours if he’s sitting down for longer than a minute haha.

Back in April, Evangeline asked to get her ears pierced. I had been dreaming of that day since before she was born. It was really special to take her out for a special day. I was more nervous than she was. She’s a sensitive girl so I fully expected her to have a hard time with it. I was so surprised that she didn’t even cry! (We vlogged about it HERE!)

The girls sure are lucky to have these 4 boys to look out for them!

Every time I post photos of Primrose with her best friend, Sylvia (on the left) I feel like I need to make it known that they are friends and not twins–although they were born on the same day. Maggi and I love to do photo shoots of the girls in matching outfits as often as possible. It’s fun to watch them starting to acknowledge each other’s existence. I hope they’re always best friends!

I don’t think I’ve posted on my blog about our Nugget yet! We actually have two of these couches now and they are easily the most played with items in our house. The kids love jumping on them, sliding down them, building forts with them, and even sleeping on them at night. We got the first one about 4 months ago and the obsession is still going strong!

This picture of the girls in the crib was supposed to be another napping picture. As soon as I set Primrose down, both of them woke up. They thought it was so funny to be in the crib together so I was able to capture their sweet smiles. It didn’t turn out how I originally planned but I think I like this version ever better!

The way Evangeline is looking at her baby sister–I’m so obsessed!

The stair step formation is always going to be my favorite!

We celebrated Evangeline’s golden birthday on May 5th! I had always envisioned a big, special birthday party when she turned 5. But when I asked her what she wanted to do, she said she wanted to spend the day with her best friend. She had such a fun birthday! I can’t believe she’s already 5!!

Getting pictures of Primrose with Sylvia is a lot easier than getting pictures of Clementine with her best friend, Mabel (who happens to be Sylvia’s older sister.) These two girls are 2 months apart and at the worst photo taking stage. But we had to at least attempt to get a picture of the girls in their matching dresses.

This is what half of Primrose’s day looks like. Evangeline likes to spend a lot of the day carrying Primrose around. Primrose definitely wasn’t amused in this photo but I think she enjoys it now.

Back in May we celebrated 14 years cancer free with my favorite, Shake Shack! I could definitely go for some of those cheese fries right about now.

For Instagram, I cropped this picture of Primrose to a square so I could cut Don out. But I really love the way he’s looking at her so I had to upload the full picture here! To the side of all the floating baby photos is Don–sometimes looking lovingly at his baby girl. But most of the time he’s making faces because his arms are getting worn out haha.

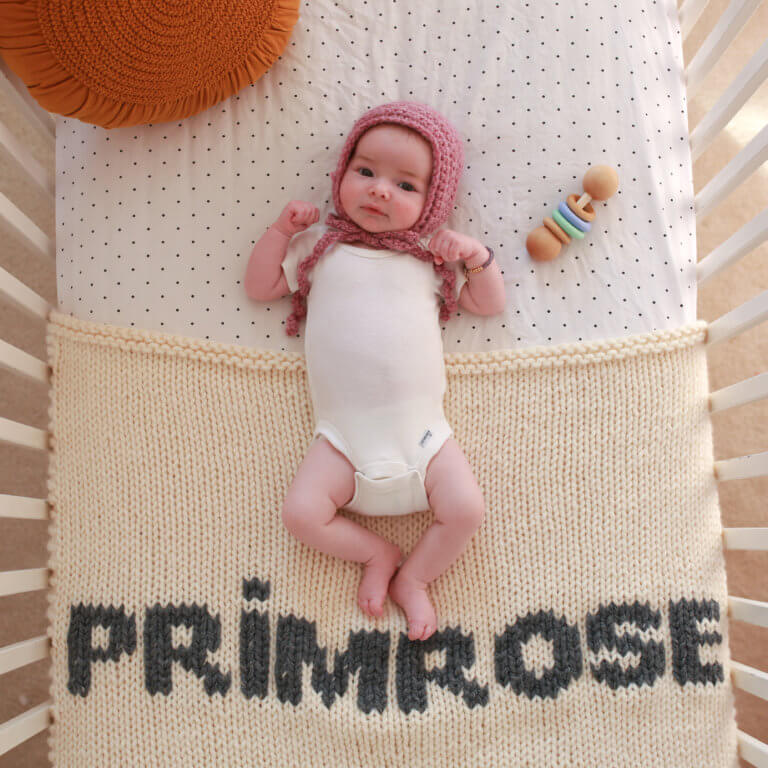

Primrose has the sweetest personality and the most heart warming smiles. But I’m telling you, this girl really makes us work to get a smile out of her for a picture. She has the best serious model face though so I guess I can’t complain.

I feel like every picture is one of my favorites–but for real, I can’t get over the sweetness of her tucked in between her Cuddle + Kind dolls.

And I’m ending this post with another picture of Kai and Primrose since this is a pretty typical sight around here.

Sorry about the photo overload! I’m going to try to do better about keeping up with things but I can’t make any promises. Now that I got this post out of the way, I feel much better about starting to work on my post about sleep!

I hope the rest of your week is great!!